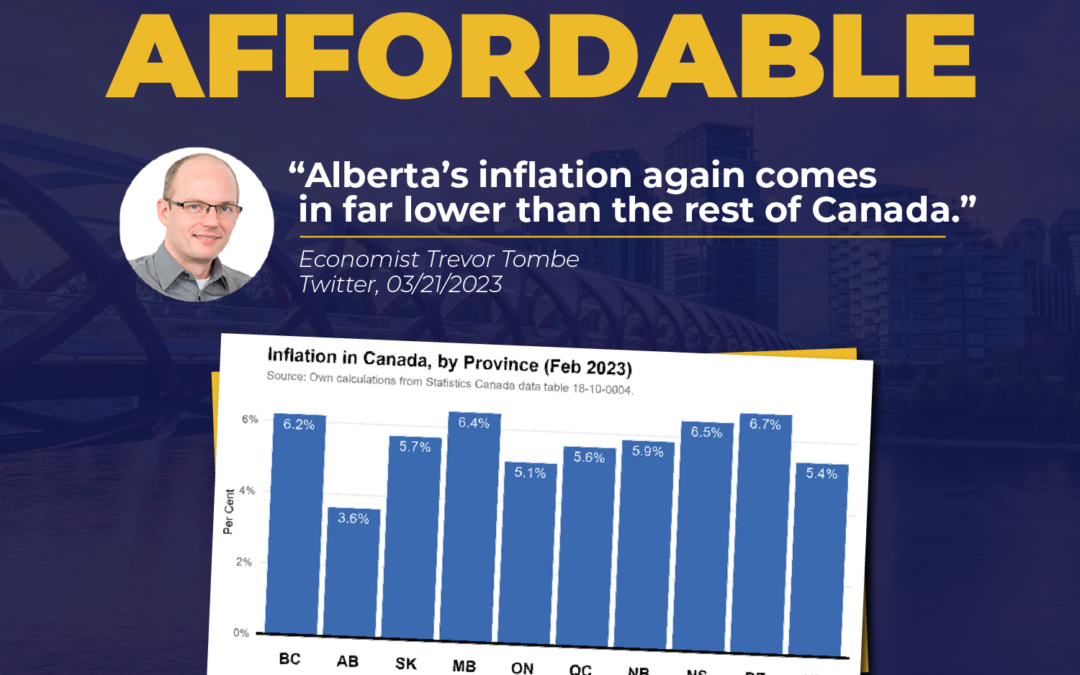

Alberta has the lowest inflation rate in Canada.

Statistics Canada’s inflation data from February 2022-Febraury 2023 shows Alberta’s inflation rate is at 3.6 per cent – a rate that comes in significantly lower than the national rate of 5.2 per cent.

Economist Trevor Tombe says: “Policy measures that lower energy prices (esp. utilities and gas) are a key reason” for Alberta’s lower rate.

This includes a number of broad-based affordability measures like the Electricity Rebate and Fuel Tax Relief. The collection of the provincial fuel tax was suspended, and Albertans are receiving up to $500 in electricity rebates.

Under the $2.8 billion Affordability Action Plan, an estimated $900 per household is also being provided.

Other targeted measures include the $600 Affordability Payments for families, seniors, and vulnerable Albertans, and re-indexing AISH and the Alberta Seniors Benefit. Support to food banks and other community groups, as well as more funding for low-income transit pass programs are also aimed at making life more affordable.

Alberta inflation statistics:

- The annual growth in the headline Consumer Price Index fell to 3.6% (y/y) in February, down from 5.0% (y/y) in January. The deceleration in the annual growth also reflects base year effects, whereby prices saw a significant monthly increase in February 2022 (+1.1% m/m).

- Electricity prices were unchanged in February relative to January. With lower prices and the rebate program, electricity prices were at the lowest level in five years (since December 2017).

- Gasoline prices declined 2.4% in February and were significantly lower than a year ago (-13.3% y/y).

- Natural gas prices dropped 17.2% in the month. Overall, energy prices were significantly (-20.8% y/y) lower than a year ago.

- Food prices continue to increase. Food prices increased 0.3% in February. With price increases in 18 of the last 19 months, food inflation remained elevated at 9.7 y/y% in February, down slightly from the 40-year high reached in November.

- Core inflation (all items except food and energy) eased. Inflation excluding energy and food edged down 0.7 percentage points to 4.8% y/y. However, the decline was less than the decline in the headline rate, and core inflation exceeded headline inflation for the second consecutive month.

- Services inflation came down. Lower prices for childcare and housekeeping services (following the federal-provincial agreement for childcare) offset the impact of soaring interest rates as both mortgage interest cost and homeowners’ replacement cost continued to experience high annual growth.

- Nationally, consumer inflation eased from 5.9% y/y in January to 5.2% in February. Lower prices for childcare and housekeeping services, inter-city transportation, fresh or frozen chicken, and natural gas offset higher prices for kitchen utensils, telephone services, women’s clothing, and mortgage interest cost.

- Alberta’s inflation rate remained below the national average for the eighth month in a row, and since the onset of affordability measures, Alberta’s inflation rate has been below the national average for 10 of the 11 months.

- Alberta’s slower inflation rate in February is partly due to affordability measures and other local factors. For example, the annual increase in rent (+1.7% y/y) has been muted in Alberta versus other provinces.

Alberta’s government is committed to keeping Alberta affordable and will continue to support Albertans in the weeks and months to come.

Red Deer-North constituents with questions, concerns or comments can reach out to the local constituency office. They can do so via the form on the contact page or by phoning (403) 342–2263.